When goods enter or leave the customs territory of the European Union (EU), they must be declared to customs.

Union goods that originate from another EU Member State are not declared to customs. These are considered as intra-Community flows and are subject to intra-Community VAT and Intrastat rules and declarations. Circulation of excise products is still regulated, under control of the Customs and Excise Administration.

Imports

All non-Union goods brought into the customs territory of the EU must be presented to customs immediately upon their arrival.

After presentation to customs, such goods may be stored in a temporary storage for a maximum of 90 days while waiting for their customs declaration.

Final importation

The final entry of non-Union goods in the EU customs territory is an importation. Such goods must be declared to customs and appropriate duties and taxes must be paid:

- customs duties

- anti-dumping duties

- import VAT

- excise duties.

After being imported, goods are considered Union goods and may circulate freely within the EU. This is called intra-Community movement. Intra-Community movements of goods however are subject to VAT and statistics (Intrastat) declarations.

Suspensive procedures on import

Upon entry in the EU, non-Union goods not intended to remain in the EU or goods waiting for their final importation, may be stored under suspension of duties and taxes.

This requires a customs declaration, and its purpose is to suspend the obligation to pay duties and taxes and the application of certain restrictive measures and prohibitions on import.

The customs suspensive procedures are the following:

- customs warehousing or free zone – goods are stored

for example, electronic components of Chinese origin are stored while waiting to be sold or used in final products

- inward processing or end use – goods are transformed

for example, electronic components of Chinese origin are used in final products

- temporary admission – goods are used prior to being re-exported unchanged

for example, American-made automobiles are temporarily presented in Luxembourg

- transit – goods are transported to another destination in the EU

for example, Brazilian bananas are shipped via transit to Paris for final importation

To benefit from one of these options, one must request prior authorization from customs authorities.

Note: Goods may be placed successively in different customs procedures.

Exportation

Final exportation

Final exportation is when Union goods exit permanently the EU customs territory. This requires a customs declaration. No duty or tax is due on the export.

There are restrictions on import/export from/to certain countries: quotas, embargoes.

Note: The exporter mentioned as such in the customs declaration must be established in the EU.

Temporary exportation

When shipped outside the EU customs territory, Union goods are intended to return unchanged or after processing. They may then be subject to a temporary export declaration to avoid having to pay customs duties at the time of their return to the EU:

- outward processing – Union goods are processed outside the European Union customs territory and return after transformation

For example, an article is sent to China for repairs

- temporary exportation – Union goods briefly leave the EU customs territory and return unchanged

For example a race horse or a painting are taken out of the EU to be shown at an exhibition.

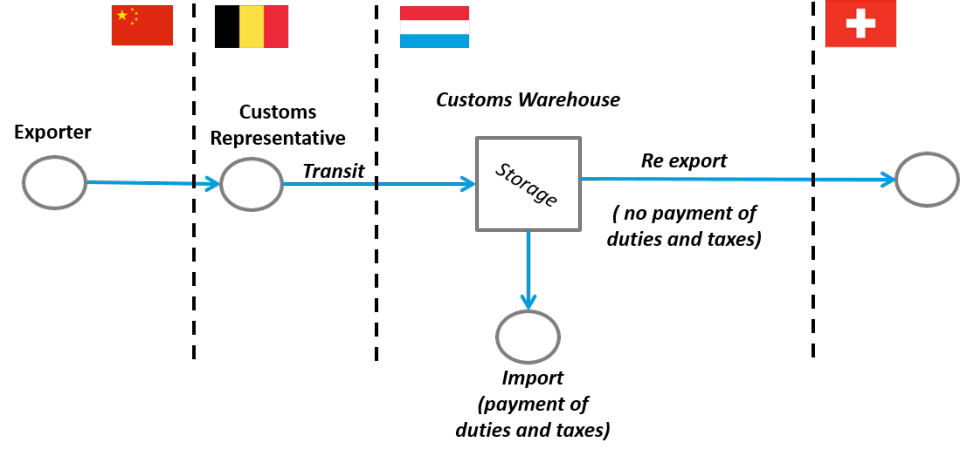

Example of non-Union goods distribution under transit and customs warehouses, for subsequent import and re-export: